Platform futures: capital one Commercial bank

Product Strategy | Interaction Design | Internal Tools

HOW MIGHT WE RE-IMAGINE THE WAY USERS CONDUCT CREDIT ACTIONS IN THE COMMERCIAL CREDIT SYSTEM?

Capital One is a leading American bank and financial services company. Established in 1988, it has grown to become one of the largest banks in the United States. The company provides a wide range of financial products and services, including credit cards, loans, banking, and savings accounts. In addition, capital one also offers small business and commercial banking solutions. Capital One's history in commercial banking is relatively more recent compared to its retail banking and credit card services. The company's entry into commercial banking started with a series of strategic acquisitions that allowed it to expand its presence in this sector.

I designed a work flow as a part of COMET, an internal platform for portfolio management. As one initiative of a greater mission for Commercial Credit (Project Gotham), this was the first milestone pilot for taking Underwriters off the HUB (an inherited platform tool) and onto COMET. Comet currently lives as a view-only platform with the only interaction capability of commentary and document upload. The goal is to transform COMET into an user-action platform.

Design Brief

Design a workflow as part of a larger platform. Users are currently conducting business in a round-about way and this workflow should aim to streamline the process.

Role & Contribution

I worked on planning user research, conducting interviews, service design blueprinting/ story mapping, prototype user testing, presenting prototypes, and working with developers to flesh out prototypes.

Deliverables

High Fidelity Prototype

Pilot Release

Overview

Outcomes

5,700 Clients migrated over to Comet

43% decrease in associate time spent in credit extensions

01. Identifying the problem

02. Understanding the workflow

03. Deciding a path forward

04. Determining streamline patterns

4 Big Takeaways

Under the guidance of a design researcher, I created an interview plan with my product manager. We conducted 12 user interviews to understand current workflow usage and pain points. From energy to commercial real estate, we learned about what made each industry special in the type of workflow they were accustomed to. Some key learnings was that through the different industries and legacy systems, there were 4 unique identified workflows that we decided needed to be condensed into one streamline workflow that lived on PT. In addition, we were able to identify key action needs that the platform would need to address as well as confirmed with our assumption that Commercial Real Estate was the hairiest industry.

People Problem:

As data sources are fragmented and workflows vary amongst different industries, there is no cohesive way of working at Capital One.

Goal:

In order to transform Portfolio Tracker, a view only space, to Comet, an action based platform, we need to deliver a comprehensive workflow that will cut down on time spent by our associates to tackle these tasks.

Challenges:

There are multiple industries and multiple stakeholders involved each with their own unique pain points.

Different stakeholders are the main user at different points in the workflow.

There is a $95B lending portfolio on the line if we cause a workflow inefficiency.

01. Identifying the problem

In order to understand the existing platform, I conducted an information architecture audit of Portfolio Tracker (PT).

From the interviews, we were able to map out a flow diagram of a streamlined version of how our users were creating proposals today. A proposal being a well packaged document that includes all of the necessary ingredients such as what is the action being taken (is it a renewal, an extension, a new deal), the included deal and facilities ( which a "deal" is a specific, one-time financial transaction or arrangement between the bank and a client, while a "facility" is an ongoing line of credit or credit arrangement that provides continuous access to funds within a specified limit), and previous risk rating. The underwriter then takes this proposal and gifts it to approvals.

We also mapped out questions that the user might have at each stage of the proposal that stemmed from the interviews.

02. Understanding the workflow

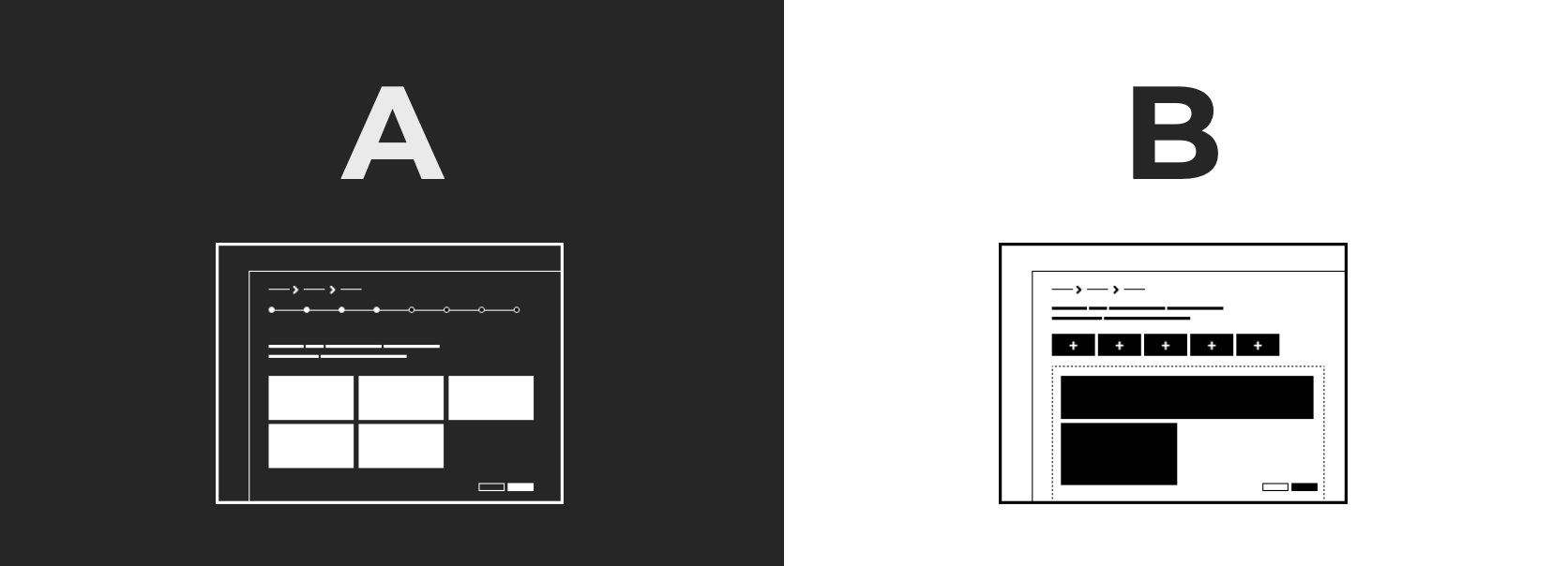

We ended with two potential ways of designing for multiple workflow patterns. A, which mimicked the way that TurboTax handles information-heavy workflows, in an easy to digest, piece by piece way. B, which mimicked the way that a build your own form would allow a user to add whatever ingredient they so desired, being the most flexible form of workflow allowing it to be adaptable to any industry and use case. Through an AB testing exercise conducted on the same previous group of catalysts, we found there to be an overwhelming preference for the turbo tax way. It was more streamline, there was less possibility for creative interpretation, and users fumbled a lot more in test B with the unfamiliar UI.

With that, we marched forward with the turbotax design. We identified all of the critical pieces/ attributes that belonged in the proposal process. With our product manager partner, we identified the first best piece to execute: an extension to an existing loan.

03. Deciding a path forward

04. Determining streamline patterns

Two critical pieces of this work was determining placement of the CTA to initiate a credit action as well as how/ what information is needed on the facilities card.

There were three prioritized locations for the credit action CTA: at the customer detail page level, the deal level, and at the global nav. Through testing and discussion with engineer partners, we determined the customer level to be best fit for pilot release as credit actions do not necessarily affect all facilities in a specific deal and changing the global nav was out of scope.

Designing the facilities card was a fun challenge. I first began with conducting a collaging and card sorting exercise with our catalysts in order to determine how they saw the pieces of information grouped together as well as how to prioritize the attributes. With each iteration, the facility card was designed to be the most efficient and streamlined version.

With collaboration with the design system team, we released the pilot for credit actions on COMET starting with the MVP of extensions.

Please reach out to e.soosea@gmail.com for a full project process walkthrough!